Facebook Pay: a comprehensive guide to the social media giant's payment system

In today's digital age, the ability to make payments conveniently and securely is crucial. Facebook, being one of the world's most popular social media platforms with 2.963 billion users worldwide, recognized this need and launched its own payment system called Facebook Pay, now introduced as Meta Pay. In this article, we'll dive deep into what is Meta Pay, how it works, and how it can benefit users.

What is Meta Pay or Facebook Payments?

Meta Pay or Facebook Pay is a payment system that allows users to make Facebook payments and purchases through social media apps, including Facebook, Messenger, Instagram, and WhatsApp. It was first launched in the United States in November 2019 and has since expanded to other countries. With Facebook Pay, users can send money to friends and family, make purchases in the Facebook Marketplace, and donate to fundraisers on the platform.

How does Facebook Pay work?

To use Facebook Pay, users need to link a payment method such as a credit or debit card or PayPal account to their Facebook account. Once the Facebook payment system is linked to the payment method, users can make transactions by entering the amount they wish to send or pay for and confirming the transaction. Facebook Pay also allows users to set up automatic payments for recurring expenses such as subscriptions.

Now, you may be thinking, “is Facebook Pay safe?”

Yes, Facebook Pay is safe. The Facebook payment system uses advanced security measures, including anti-fraud technology, advanced data storage, encryption for payment card and bank account details, and two-factor authentication for logins. If Facebook Pay detects unusual activity, alerts will be sent to notify users. Besides, you can use a personalized Meta Pay PIN or a fingerprint or face ID to keep your information secure. You will be able to view your Facebook payment history and manage your payment methods in the Facebook Pay settings.

Benefits of using Facebook Pay

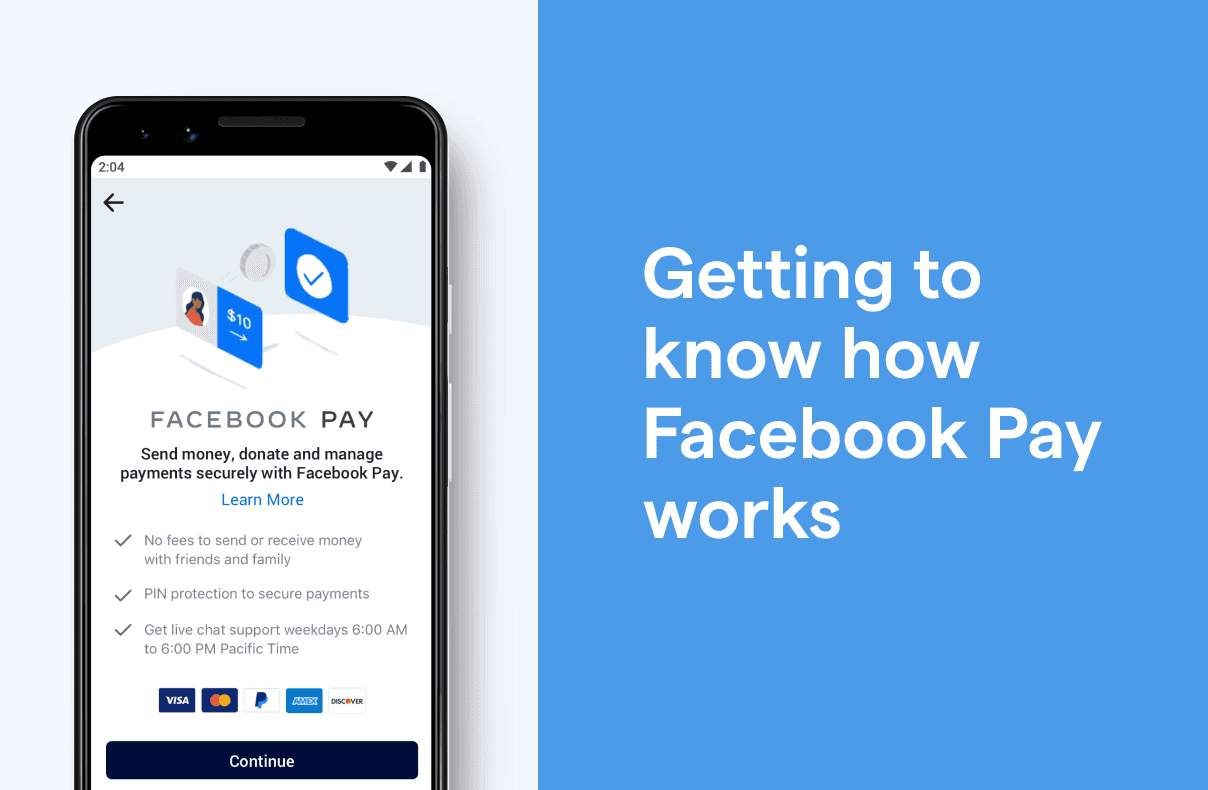

Image from Facebook

One of the main advantages of using Facebook Pay is convenience. Users can make payments without leaving the Facebook app, making it easy to complete transactions while chatting with friends or browsing the marketplace. Facebook Pay also supports multiple payment methods, making it easy for users to choose their preferred payment option.

Another benefit of Facebook Pay is its security features. With its use of a Meta Pay pin, data encryption, and two-factor authentication, users can feel confident that their payment information is secure. Additionally, Facebook Pay does not store or share users' payment information with third-party apps or services, adding an extra layer of security.

How do you use Facebook Pay

Image from Facebook

Facebook Pay is not just for individuals looking to make quick and secure transactions on the Facebook app. Businesses can also use Facebook Pay to streamline their payment processes and offer customers an easy way to pay for goods and services. Here are some of the ways businesses can use Facebook Pay:

1. Collect payments from customers

Businesses can use Facebook Pay to collect payments from customers for products and services they offer. This can include payments for subscriptions, memberships, or one-time purchases from Facebook Shop or Instagram Shop. The moment a customer decides to buy your product after resolving inquiries on Messenger or Instagram DM, Facebook Pay allows them to checkout and make secured payments easily.

Wondering how you can sell better on social media? Explore all you need to know about advanced social selling tools.

2. Make donations to a charity or personal fundraiser

Many businesses engage in corporate social responsibility initiatives and participate in charitable giving. If you’re one of them, you can consider using Facebook Pay to make donations to charities or personal fundraisers directly on Facebook, supporting causes you believe in while improving your brand reputation.

3. Buy and sell items on Facebook or Instagram Shops

Facebook and Instagram, which are both owned by Meta, have become popular social media platforms for businesses to showcase their products and services while cultivating customer loyalty and improving conversion. With Facebook Pay, businesses can easily sell their products on Facebook and Instagram by accepting payments directly on the app. Customers can complete their checkout process seamlessly without switching apps or getting redirected to the e-commerce site.

Did you know that you can actually draft orders for customers in the chat? Check out the incredible features of the native Shopify integration.

4. Make in-app game purchases

If your business offers mobile games or apps, Facebook Pay can be a useful tool for in-app purchases. With Facebook Pay, users can make purchases within the app without the need to leave the game or app.

5. Sell tickets for events

Business events are essential for getting more brand exposure. As you organize webinars or workshops and sell tickets to customers, you can use Facebook Pay or Meta Pay to collect payments from the participants. You can even incorporate the Facebook payment system into your chatbots, engaging customers or leads from Facebook Ads or post comments.

Need a ready-to-use interface to incorporate payment CTAs into your chatbots? Try SleekFlow.

6. Sell as a participating online shop

Facebook Pay also allows customers to make purchases in participating online shops. If you enable Facebook payments on your e-commerce stores, you will make it convenient for your customers to buy your products and more likely to return for more purchases.

Limitations of Facebook Pay

While Facebook Pay offers many benefits, there are also some limitations to consider. For example, Facebook Pay is only available in selected countries, and not all payment methods are supported. Here are some of the available countries for reference:

Although Facebook Pay does not specify its transaction limits on the official website, Messenger does have a Facebook Pay limit for its transactions, which is around $10,000 depending on the type of Facebook payment used, such as Visa or Mastercard debit card and PayPal.

How do I sign up for Facebook Pay

To get started with Facebook Pay, you will need to link a payment method to your Facebook account.

To set up FB Pay on Facebook and Messenger:

Click your profile picture in the top right of Facebook.

Select ‘Settings and privacy’, then click ‘Settings’.

Click ‘Payments’ on the left-hand side.

To set up FB Pay on Instagram:

Open the Instagram app for iOS or Android.

Tap on your profile at the bottom right.

Tap on the menu (three horizontal lines) on the top right.

Select ‘Orders and payments’.

You can then add your payment information, set up FB Pay with a PIN for safety, and manage your transactions from there on.

Do note that Facebook Payment’s availability on different channels varies depending on countries.

Facebook Pay not working: troubleshooting issues

While Facebook Pay offers many benefits, users may sometimes experience issues with the Facebook payment system. Here are some common issues and troubleshooting steps to resolve them:

Payment method not accepted

If your payment method is not being accepted on Facebook Pay, try linking a different payment method. Facebook Pay supports multiple payment options, including credit and debit cards, PayPal, and other payment methods depending on the country.

Transaction declined

If a transaction is declined, it may be due to insufficient funds or an issue with the payment method. Check that you have sufficient funds in your account and that the payment method is up-to-date and valid. If the issue persists, contact your bank or payment provider.

Facebook Pay is not available in your country

Facebook Pay is not available in all countries, so if you are unable to use Facebook Pay, it may be because it is not yet available in your country. Facebook is working to expand the availability of Facebook Pay to more countries, so keep an eye out for updates.

Check out Facebook Pay’s availability in your country in the table above.

Facebook app not updated

If you are having issues with Facebook Pay, make sure that your Facebook app is up-to-date. Check for updates in the app store and install any available updates.

Age restrictions

According to Facebook’s Community Payments Terms, obtaining the consent of a parent or guardian will be necessary for users under the age of 18 to use Facebook Pay.

Bug issues

Sometimes, there might be some bug with the app or browser which you’re using for Facebook Pay. Reinstall the app or clear browser cache and then try again.

Contact Facebook support

If you are still experiencing issues with Facebook Pay, contact Facebook support for assistance. They can help troubleshoot the issue and provide guidance on how to resolve it. By following these troubleshooting steps, you can resolve common issues with Facebook Pay and enjoy the convenience and security of making payments through the Facebook app.

SleekFlow Payment Link: an alternative to Facebook Pay

Since Facebook Pay is not available in all countries, business owners may need to find a convenient and secure alternative to allow customers to pay in the chat on Facebook or Instagram, especially for merchants with Facebook Shop and Instagram Shop set up for their business. SleekFlow Payment Link, as the best Facebook Pay alternative, offers advanced security features with Stripe integration, enabling convenient in-chat payments while providing users with peace of mind as their payment information is protected. With just a few clicks, sellers can instantly collect payments from customers and manage payments and transactions with ease. If a specific product is out of stock or lost in shipping, refunds are also made easy with this feature. Returning customers will not need to reenter their information if they were to make another order while chatting with your sales agents.

Interested in SleekFlow Payment Link? Find out more about how this omnichannel in-chat payment link feature works.

Frequently Asked Questions

Further reading:

Share Article